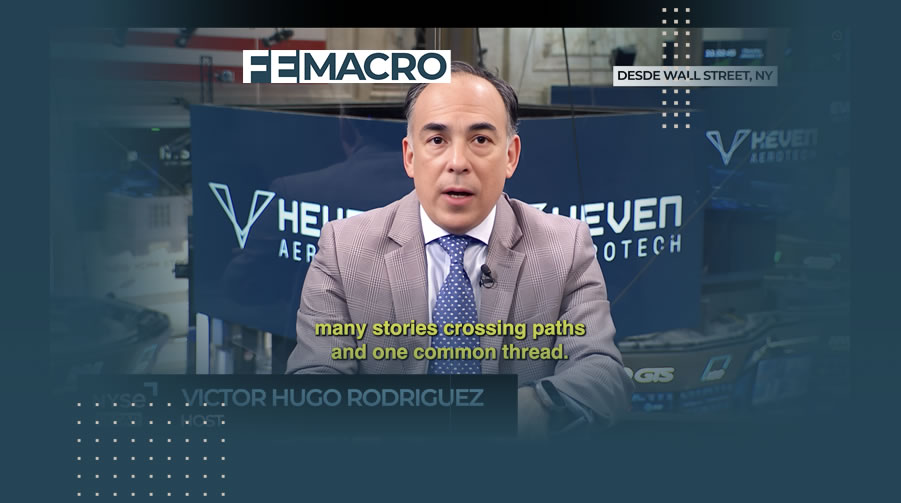

Broadcast from the floor of the New York Stock Exchange, this FE Macro conversation features Víctor Hugo Rodríguez alongside Daniel Osorio, founder of Andian Capital Management, a Colombian investor widely recognized for his deep knowledge of Venezuela and Latin American capital markets. Recorded on January 15, 2026, the discussion focuses on Venezuela’s evolving political and economic situation and its broader implications for the region.

Osorio explains that developments over the prior two weeks represent a turning point not only for Venezuela, but for all of Latin America, spanning macroeconomics, investment flows, and democratic stability. He emphasizes that the issue goes far beyond oil, touching immigration, security, and regional integration, with meaningful consequences for Latin Americans both in the region and in the United States. Referencing recent commentary from BlackRock leadership on CNBC, Rodríguez notes that Venezuela is expected to be a central topic at the upcoming Davos World Economic Forum.

From an investment perspective, Osorio outlines oil as the initial engine of recovery. Venezuela’s crude production, which collapsed from roughly 3.5 million barrels per day to under one million, could rise by 300,000 barrels per day with modest investment, and potentially return to three million barrels over a seven-to-ten-year horizon with sustained capital. This rebound, he argues, would serve as the macroeconomic backbone of a new Venezuela and generate positive spillovers for Colombia, Brazil, Peru, Ecuador, and Chile.

Osorio also describes receiving dozens of calls from major global funds seeking exposure to Venezuela’s reopening, with a common question: how to participate in its geopolitical and financial renaissance. The conversation concludes with his outlook on U.S. markets, where he sees significant capital waiting to deploy, expectations for lower interest rates, and optimism around growth as the Dow approaches 50,000. He adds that Bitcoin remains particularly relevant for Latin America, underscoring a constructive view on both U.S. and regional opportunities.